Underreported mileage causes an insurance company to industry billions of dollars in losses every year. But what exactly is underreported mileage, and how can insurance businesses avoid it?

What is underreported mileage?

Underreported mileage is a form of soft fraud. It occurs when policyholders report a certain number of miles driven, even though their actual mileage is a lot higher.

This actually happens pretty frequently. Research shows that the 80% of policies that are self-reported today have an error rate about 15 to 20%. The average number of miles reported to an insurance company is 44% lower than the average annual miles driven collected by the Federal Highway Administration (FHWA) — and that’s an estimated 6,049 of underreported milage.

An insurance company allows policyholders to self-report mileage by letting them know via phone call or uploading a picture of their odometer. This common practice invites policyholders to give rough estimates rather than accurate statements, causing unintentional underreporting. But this also makes it easier for drivers to intentionally underreport mileage for lower premiums.

The causes behind intentional underreporting is complex. While some drivers may simply be looking for an easy way to out to reduce insurance rates, many are compelled to do so because of growing budget strains imposed by existing rates.

Research by Insurify shows that although underreporting occurs across all US states (highlighting the prevalence of human error), nine of the 10 states with the highest underreported mileage have a higher poverty rate than the national average.

Why underreported mileage is a bigger issue than you think

Underreported mileage incurs losses across an insurer’s business:

- Underestimated mileage means underestimated risk: If a driver chooses to self-report mileage that's lower than their actual, insurers are more likely to charge low-risk premiums for high-risk drivers. The rate at which insurers are having to pay out claims will also be higher than anticipated. Over time, this mispricing leads to significant revenue loss.

- Denied claims are rarely straightforward: Big discrepancies in mileage reporting means more denied claims. The implications of this for drivers is apparent, but for insurers? The cost saved from a payout is quickly offset by longer claims review processes, more legal disputes, and a growing bad reputation among drivers.

- Any kind of fraud invites scrutiny: Even if drivers are the ones misreporting mileage, insurers hold the responsibility of accurately assessing risk and maintaining fair pricing. In some US states, negligently relying on inaccurate mileage data violates regulations around maintaining the accuracy of rating factors and preventing unfair pricing.

- The cost of fixing wrongs: Investigating underreporting takes time, effort, and of course, money. Insurers have to dedicate staff to verify mileage, investigate discrepancies, and handle customer complaints related to mileage reporting.

But although underreported mileage may lower premiums for drivers, it does hurt them in the long run:

- The cost of being found out: If a driver's claim is denied due to mileage discrepancies, they’re left to pay for damages out of pocket. If insurers find out, drivers also have to bear the costs of legal consequences due to fraud or a complete loss of coverage.

- Increased premiums — for everyone: When insurers have to pay out more claims than they had accounted for, they’ll raise premiums for all their customers to make up the difference. Yes. Including those who self-report mileage accurately.

Self-reported mileage just doesn’t cut it anymore. What will?

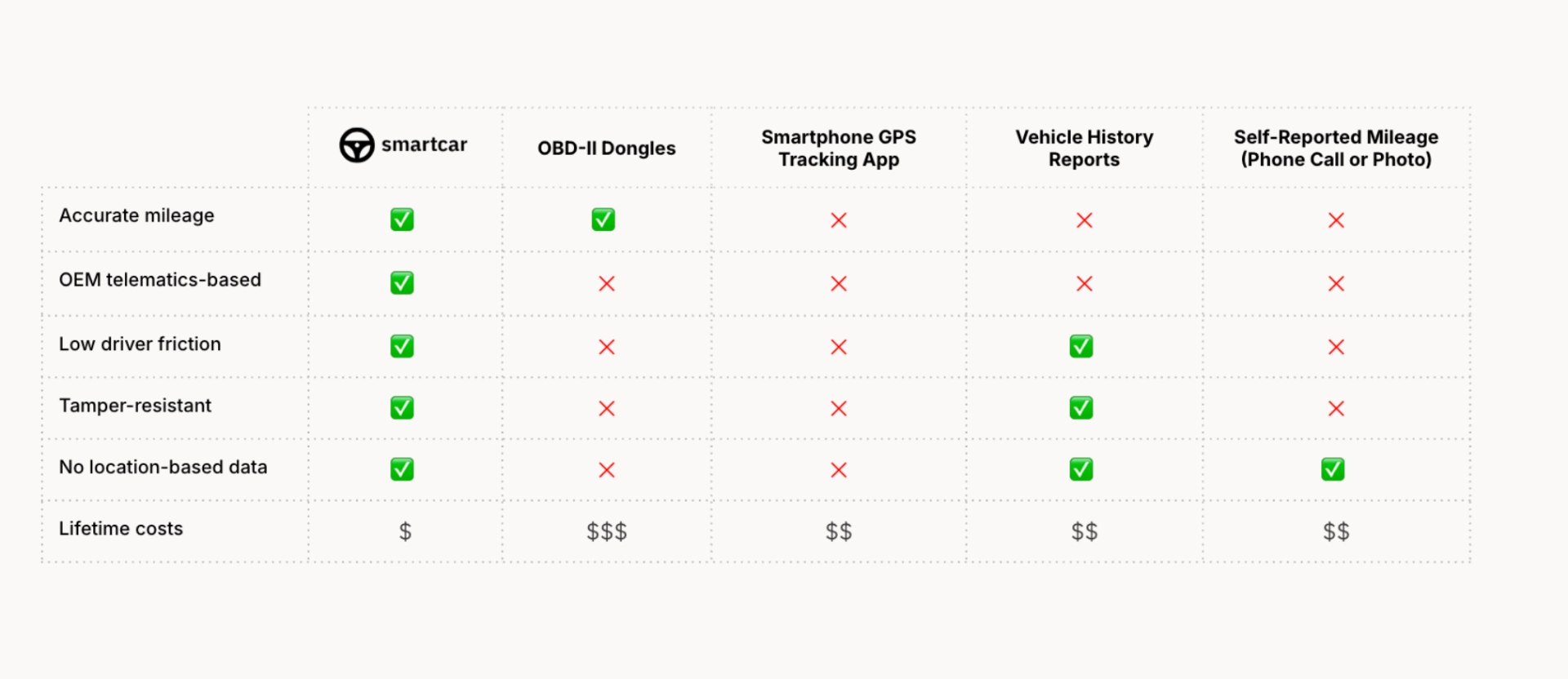

The path for an insurance company to avoid underreported miles is simple: Use a car’s actual odometer reading instead of relying on self-reporting and other tamper-prone solutions. While aftermarket hardware like OBD2 mileage trackers or smartphone apps offer theoretical improvements, they come with their own set of challenges.

The ideal solution has to go beyond the shortcomings of legacy mileage verification methods. It demands a system that delivers:

- Complete accuracy: Estimates based on location or trip data isn’t enough. What an insurance provider needs is direct access to the vehicle's true odometer reading, eliminating margins of error and delivering truly accurate mileage. Insurers also need a system that delivers fresh, accurate data at regular intervals, enabling precise underwriting and timely policy adjustments.

- Less susceptible to fraud: Tamper-proof data is non-negotiable. Any solution that can be easily manipulated undermines the very purpose of mileage verification.

- Ease of use for drivers: High-friction solutions that require extensive driver involvement or costly hardware installations are impractical for boosting mileage verification accuracy. The optimal approach must be seamless, minimizing disruption and maximizing adoption.

- Cost-effective implementation: The solution must be economically viable, minimizing upfront costs and ongoing operational expenses (that extend far beyond an annual mileage check). High priced hardware and intensive administrative costs for continued success are no longer viable solutions.

The new standard for mileage verification

By automating mileage verification with Smartcar, you can significantly reduce fraud and save valuable time. Shifting from a reactive to a proactive approach to mileage verification accuracy unlocks numerous benefits:

- Fresh data acess: Obtain up-to-date mileage information whenever needed, not just at annual renewals. An insurance provider can also use this data to implement or grow a pay-per-mile insurance program for policyholders.

- Continuous verification: Replace manual, annual updates with continuous, automated verification.

- Happier drivers: Reduce the burden on policyholders, leading to greater satisfaction and retention.

The Smartcar API empowers auto insurers to take control of their data, mitigate risk, and drive profitability. Speak to our team to learn how you can eliminate the costly inefficiencies of underreported mileage and build a more secure and efficient business.

.png)

.jpg)