A lot happened in the EV space in 2022. The rise of EV adoption has brought us more insights — like EV statistics about sales increases, the cost of ownership, and how EVs can impact our energy bills. In this article, we summarize our favorite EV statistics from the past year that shine a light on what to expect moving forward.

The United States has reached the 5% tipping point for EV adoption

(Source: Bloomberg)

In the first nine months of 2022, battery-powered EVs (BEVs) accounted for 5.2% of all new light-vehicle registrations. A year ago, this number was 2.8%.

When you look at EV adoption data from countries like Norway, China, and South Korea, you’ll notice an S-shaped curve that took off right around the 5% mark.

18 countries before the United States (13 of them located in Europe) have already seen their EV sales exceed 5% of total new car sales. After that point, sales took off. EV sales in Europe are now at a 10.6% market share.

What caused this upward trend?

EV production has met the same obstacles worldwide: disrupted supply chains, weak charging infrastructure, limited government investment and incentives, and a lack of EV awareness and education among vehicle buyers.

Bloomberg’s Tom Randall writes that “once the road has been paved for the first 5%, the masses soon follow.”

In the US, efforts to overcome the aforementioned obstacles include $7.5 billion dollars for a network of 500,000 chargers, federal tax credits on EVs, and $20.8 billion for the production of lithium-ion batteries.

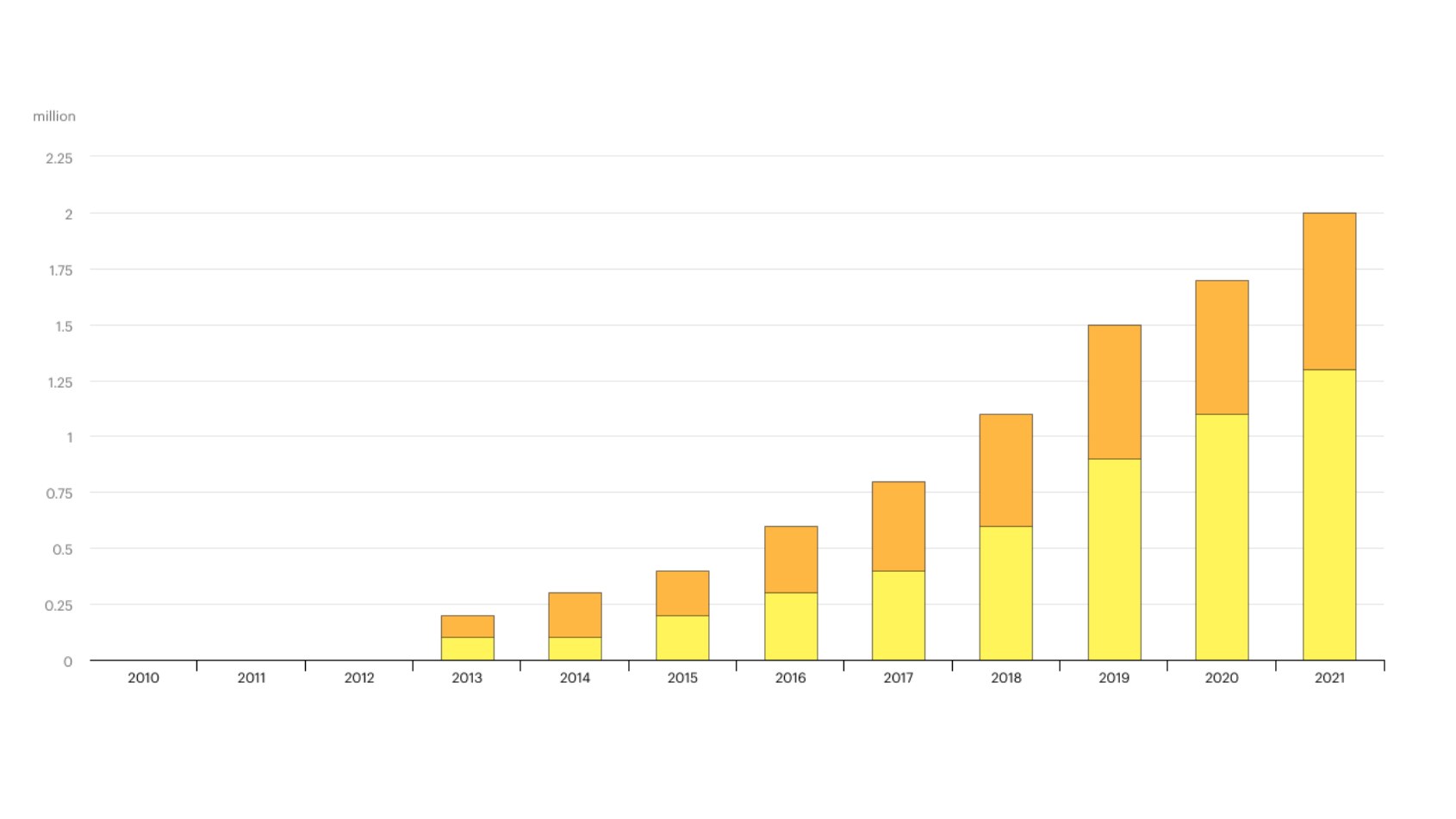

More than 1.5 million new EVs were sold in 2022 across the US and Europe

(Source: EV Universe)

The EV Universe newsletter analyzed EV registration data in the US and Europe and highlighted some great findings. Let’s dive into each region.

👉 US:

At the end of 2021, there were roughly 2 million electric light-duty vehicles on the road — including 700,000 plug-in hybrid electric vehicles (PHEVs). This is more than triple the number of EVs in operation five years ago.

530,577 new battery electric vehicles (BEVs) were sold in the first nine months of 2022. This puts the US at 57% growth year-over-year for BEVs, and brings the total number of EVs in operation closer to the next million mark.

👉 Europe:

At the end of 2021, there were roughly 5.5 million EVs on the road — including 2.5 million PHEVs. This brings the total number of EVs in operation to over nine times what it was five years ago.

EV sales have steadily increased since then, with 1,002,720 new BEVs registered from January to September 2022. In October, the total market share for BEVs in Europe stood at 13.6%.

Global automakers will invest over $1 trillion in EVs and batteries from now until 2030

(Source: Reuters)

Reuters conducted an analysis of 37 automakers in 2022 and discovered that projected investments are more than double their calculations published in 2021.

According to the study, the companies expected to produce the most EVs in 2030 are Tesla, Volkswagen Group, Toyota, Hyundai/Kia, Stellantis, General Motors, and Ford.

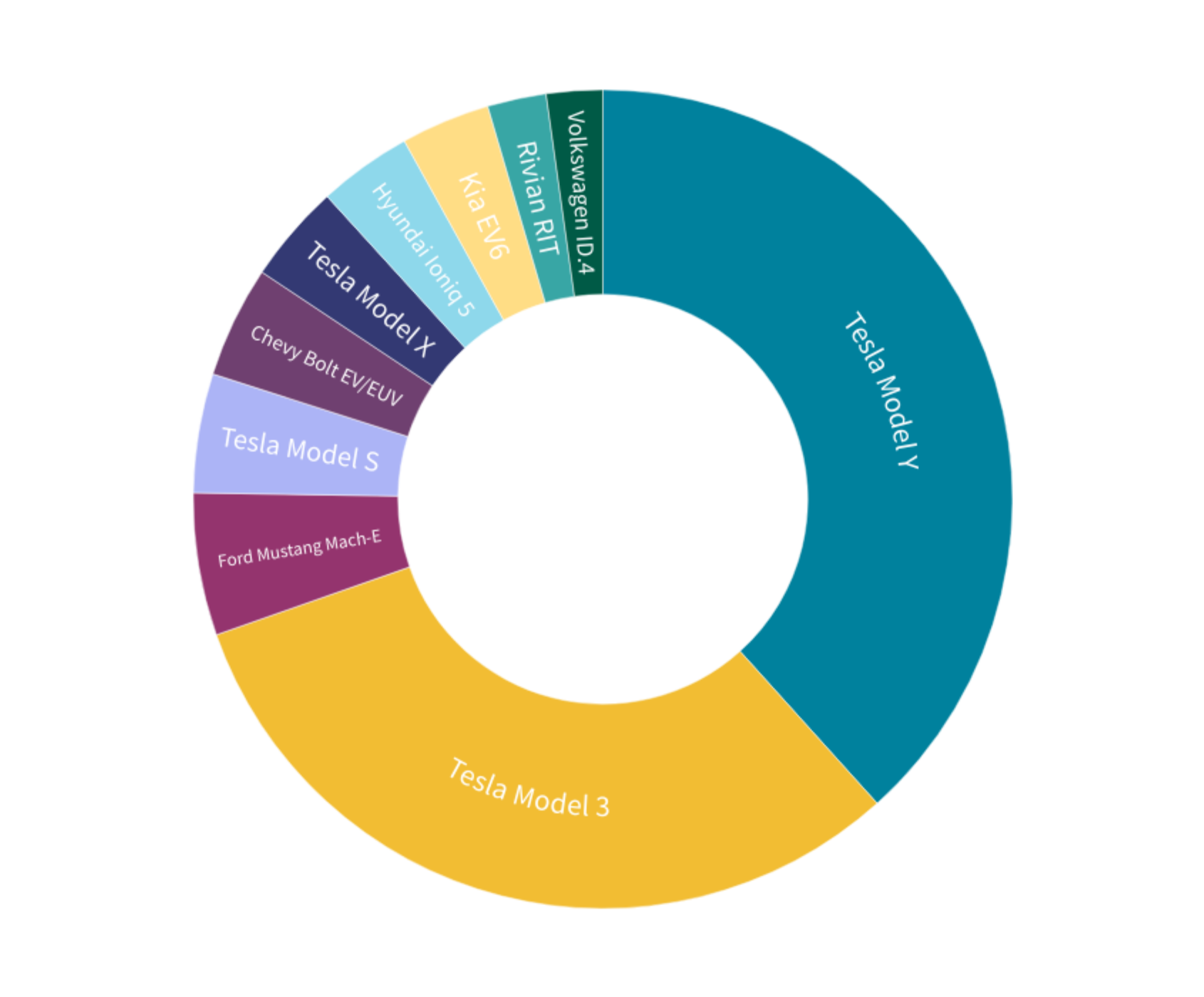

Looking back at the early days of EV adoption, we might imagine many Teslas. But Tesla is no longer the only automaker committing to the mass production of electric vehicles. A report by S&P Global Mobility shows that the brand made up 79% of all new US EV sales in 2020, but its majority declined to 65% in Q3 of 2022.

More US states are joining California’s pledge to ban gas-powered cars by 2035. The same decision has been made in the European Union.

As a result, we see an uptick in automakers launching more affordable EV models to rival Tesla — like the Hyundai IONIQ 5 and Kia EV6 which have been climbing their way up the sales charts.

Smartcar's API is compatible will over 100 EV models — including the ones on this list. Check out our compatibility page to see all the makes and models your app can connect to using Smartcar! 📈

The number of charging ports in the US increased by 29% from 2021 to 2022

(Source: Visual Capitalist, Elektrek)

One of the biggest bottlenecks for widespread EV adoption is the availability of charging infrastructure, which should be as convenient as pulling up to a gas station and filling up your tank. There are 145,000 gas stations in the US today — almost triple the number of EV charging stations.

The EV charging landscape is far from pretty. But it isn’t all bad news.

There were roughly 108,000 charging ports in the US in 2021. Last year, government officials reported that this number climbed to about 140,000 ports across 53,000 charging stations.

The minimum standards have been set for states to access the first $5 billion from the bipartisan infrastructure bill, so we can expect more requests for proposals to start coming in over the next few months.

Building a new renewable energy infrastructure from the ground up will take time, but the Department of Energy (DOE) calls on the help of technology innovators to make it easier for utilities to accommodate more EV charging.

DOE’s Alejandro Moreno tells Utility Dive that the biggest challenges lie in aggregating and managing new energy demand. “The ability of demand flexibility to provide critical services to the grid is essential,” he says.

EVs are 3 to 5 times cheaper to drive per mile than gas-powered vehicles

(Source: Zero Emission Transportation Association)

The Zero Emission Transportation Association (ZETA) compared the operating costs of gas-powered vehicles and EVs across the US. The full report highlights a few reasons why EVs ownership proves to be more affordable in the long run:

- EVs are not influenced by the volatility of gas prices and can instead operate on stable, renewable, and locally-produced energy sources

- EVs operate at a lower cost per mile than gas-powered vehicles because the average price per kilowatt-hour of energy is much lower than the average price per gallon of gasoline

- EVs can save drivers between $1,800 and $2,600 on operating and maintenance costs

The up-front costs of EVs have been one of the biggest obstacles holding mass adoption back. But with more competition between automakers and regulations like the Inflation Reduction Act, the prices of new EVs are dropping.

On January 13, 2023, Tesla announced it was dropping prices across its lineup in the US, Canada, and Europe. In the US, price cuts fall between the range of $3,000 to $19,000.

Other EV models with reduced prices in 2023 include the Chevrolet Bolt and Bolt EUV, Nissan Leaf, and Hyundai Kona Electric.

EV accessibility will continue to be an uphill battle, but we don’t have to rely solely on tax credits and automakers to make affordability a reality. Stacy Noblet, VP of Transportation Electrification at ICF, tells us that opportunities also lie in the used EV market, rideshare, and the involvement of utilities in planning charging infrastructure.

Access to mobility data will be critical to bridging gaps in our sustainable mobility ecosystem.

“There's some cool data that can come out of rideshare about where [EVs] are traveling, how they're picking up people, and that will help inform programs moving forward,” she says. “The data that comes out of those pilots can really point to gaps that we may not be aware of.”

EVs can cut fleet maintenance costs by half

(Source: The Driven)

Research shows that consumers who use car sharing services like Turo are more likely to find EVs useful and reliable.

Car rental operator, Hertz, revealed that the cost of maintaining their Tesla fleets is 50 to 60% lower than their gas-powered fleets. The durability of EV parts also results in fewer rental cars being taken off the road to be serviced.

Low maintenance costs and more rental uptime can help fleet operators provide more affordable options at scale. On top of that, it encourages low-emission travel without making private EV ownership a requirement.

Companies like Zeti are also making it easier for fleet operators to finance their EVs through a pay-per-mile model that makes operating costs more sustainable for companies with variable fleet usage.

Less than 15% of EV charging for time-of-use rate customers occurred during on-peak hours

(Source: CleanTechnica)

A recurring argument against EV adoption is that it would raise energy prices even further by straining the grid during peak periods and incurring more costs for system upgrades.

But a study by Synapse Energy debunked the theory and discovered that in some US service territories, EV charging had contributed roughly $1.7 billion more in revenue than utility costs. This resulted in lower electricity rates for all customers.

The study cites that the main reason why EV revenue outweighs costs is that EV charging usually takes place during off-peak hours. Only 9 to 14% of time-of-use (TOU) rate customers charge during hours of higher demand, while the rest charge overnight when the grid has more capacity.

Proactively shifting EV charging to off-peak times will not only increase revenue and lower overall electricity rates, but also allows our grid to accommodate more EVs without having to reconstruct distribution systems from scratch.

Companies like Optiwatt, Rolling Energy Resources, and EnergyHub work with utilities to make their systems more flexible with managed charging programs. This allows electricity providers to start and stop charging according to the volume of demand or the availability of renewable energy.

What this means for the future of mobility

Smartcar works with mobility innovators equipping consumers, governments, and energy providers with the flexibility to make EVs work for them. Our EV APIs are used to power apps for zero-emission car sharing and rentals, smart charging, fleet financing, auto insurance, and more.

If you’re interested in hearing more EV industry news and the opportunities it holds for mobility apps, subscribe to our newsletter and book a meeting with our team to learn about our EV APIs.