At Smartcar, we have a front-row view of drivers' enthusiasm for connected car apps. We see this daily as our customers rapidly onboard vehicles onto our platform across all kinds of mobility use cases.

However, we know there is skepticism about the benefits of vehicle connectivity and third-party solutions. There are overarching assumptions that vehicle connectivity leads to compromised driver privacy and vehicle safety — which is entirely possible if automakers, solution providers, and data platforms operate with little regard for consumer choice and data transparency.

Given the trends we saw on our platform, we knew there was an opportunity to explore what drivers felt about third-party connected car apps. What motivates them to download these applications? What do these applications have that their automaker’s connected services don’t? What data privacy measures do drivers find important?

So, we conducted our first annual State of Connected Car Apps report.

In this report, we asked a randomized pool of drivers in the United States these questions. The survey respondents owned a mix of connected and unconnected cars and electric and gas-powered vehicles. Our report explores:

1. Driver sentiment about third-party apps

2. The features & compatibilities that motivate drivers to use third-party car apps and services

3. The types of services drivers want to access with vehicle telematics

Here are five learnings we discovered from the report and discussed in an expert panel with TechInsight’s Roger Lanctot, Recurrent’s Scott Case, and Smartcar’s Dan Teeter.

#1: Drivers want more than what’s offered in their connected services app

Over the past decade, automakers have done little to change the core features offered in their connected services, which tend to revolve around navigation and remote service features. However, drivers today want to use telematics to interact with their vehicles in a more personalized and purpose-driven way — which is why they turn to applications like Recurrent to fill that gap.

"The amount and pace of innovation [in connected services] hasn’t kept up with the industry standard — which everyone compares to their smartphone that is always getting better.

If automotive telematics platforms aren't able to even approach that level of innovation and pace of change, it's viewed as underwhelming. That’s a perception we'd like to find a way to change in the market."

— Dan Teeter, Director of Partnerships at Smartcar

Take the EV revolution as an example. Many connected services applications don’t give EV owners all the necessary functionalities to make sense of their vehicle health and performance.

Recurrent has almost 20,000 individual EV drivers who connect to the platform to get regular battery reports that compare the condition of their battery to other EVs out there. An EV manufacturer’s app doesn’t give drivers this information, with their connected services typically providing visibility into EV battery levels and charging preferences.

“You used to get your oil changed [in a combustion engine car] and you would get feedback from your mechanic a couple times a year and they put that little sticker on your windshield to say that everything looks great,” Scott says. “People aren’t getting that with EVs so they think of our application as a version of that sticker.”

#2: Drivers don’t want to pay for underwhelming vehicle telematics

Cost is the biggest cause of dissatisfaction with connected services. For a long time, automakers have been trying to figure out how to entice drivers to pay for connected services. Each automaker has its own pricing and payment terms, some more attractive than others, to get more engagement with telematics offerings.

Our panel of experts says that this pushback on cost is ultimately about more than just cost itself. It’s about paying for something you don’t like and don’t want to use.

The lack of alignment between drivers’ desired functionality and what’s in their connected services app leads to low levels of engagement and a lack of familiarity with how to use the application. This, in turn, creates a repeat cycle of drivers not finding value from connected services, having their automaker app become an afterthought, and then becoming frustrated when they have to pay a subscription fee.

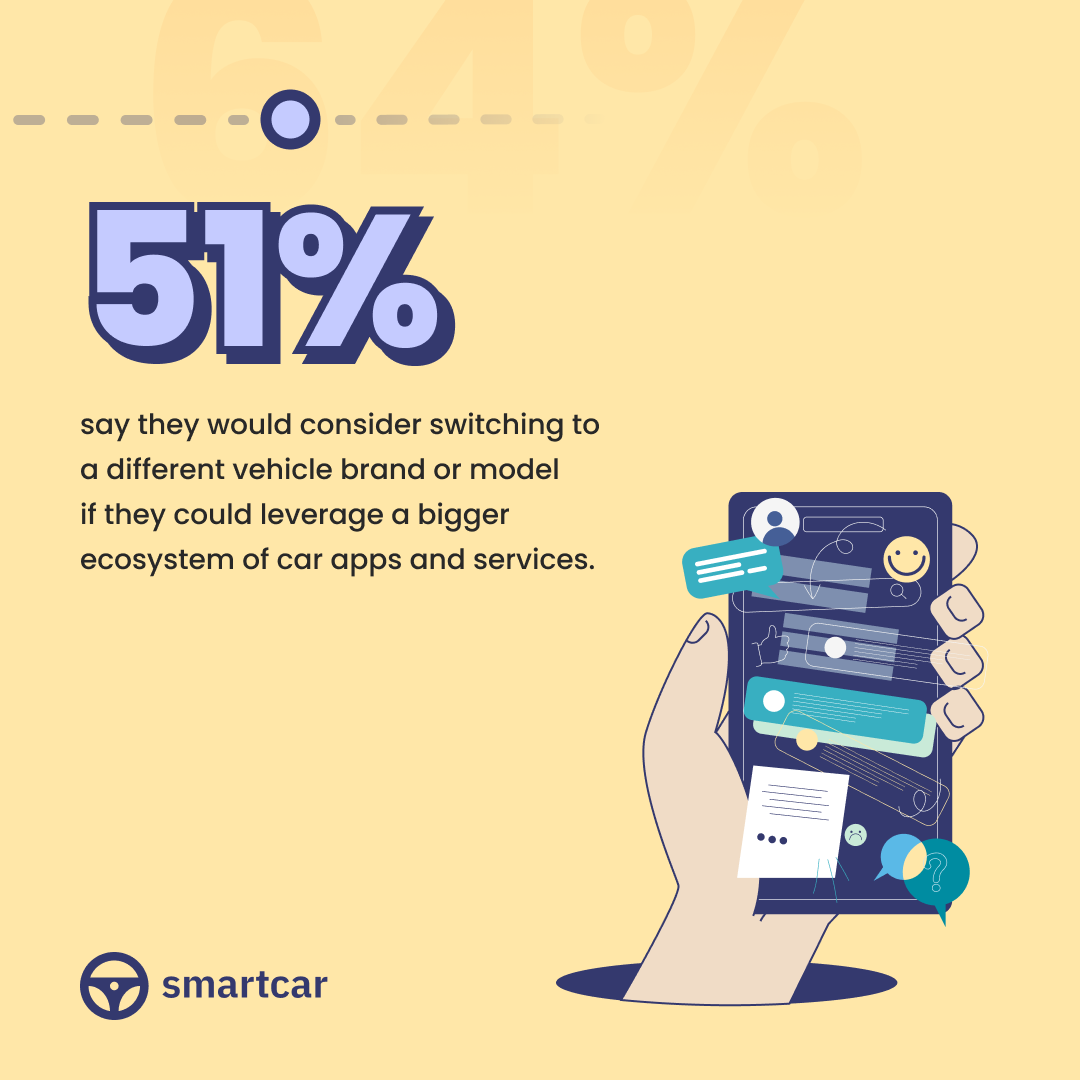

#3 Drivers want vehicles that give them access to innovative services.

For half of the drivers we surveyed, an attractive vehicle doesn’t necessarily mean one with many built-in features — but rather one that unlocks opportunities to use external applications to fill that gap.

When drivers can use their automaker’s connected services to connect to purpose-built solutions — like Recurrent for battery reports, Bidgely for managing EV charging, and Uber to take on rideshare trips in their EVs — they’re more inclined to use or purchase a particular vehicle because of its connected services capabilities.

For automakers, this means more engagement on their connected services platform and, in the long run, more sales for their new connected cars.

This is why Smartcar believes open collaboration between automakers and third-party developers will result in more innovation, faster electrification, and a deeper understanding of driver preferences.

The findings of this report further support our mission to bridge the gap between automakers and third-party mobility applications with secure and standardized API integrations.

#4 Drivers want connected services to power a wide variety of use cases

From remotely locking and unlocking cars to scheduling EV charging and analyzing battery health, vehicle telematics unlocks countless use cases — just look at the diverse range of solutions Smartcar customers are building with our API.

Automakers can’t tackle this range of functionality by themselves.

This is another argument that supports the value of collaboration between automakers and third-party developers.

Electric vehicles are currently leading the charge for innovation in telematics. We’re seeing a huge spike in software solutions built for EV drivers, charging networks, utilities, and even departments of transportation. If automakers restrict consumers from accessing these services, the vacuum of information about electrification will only widen.

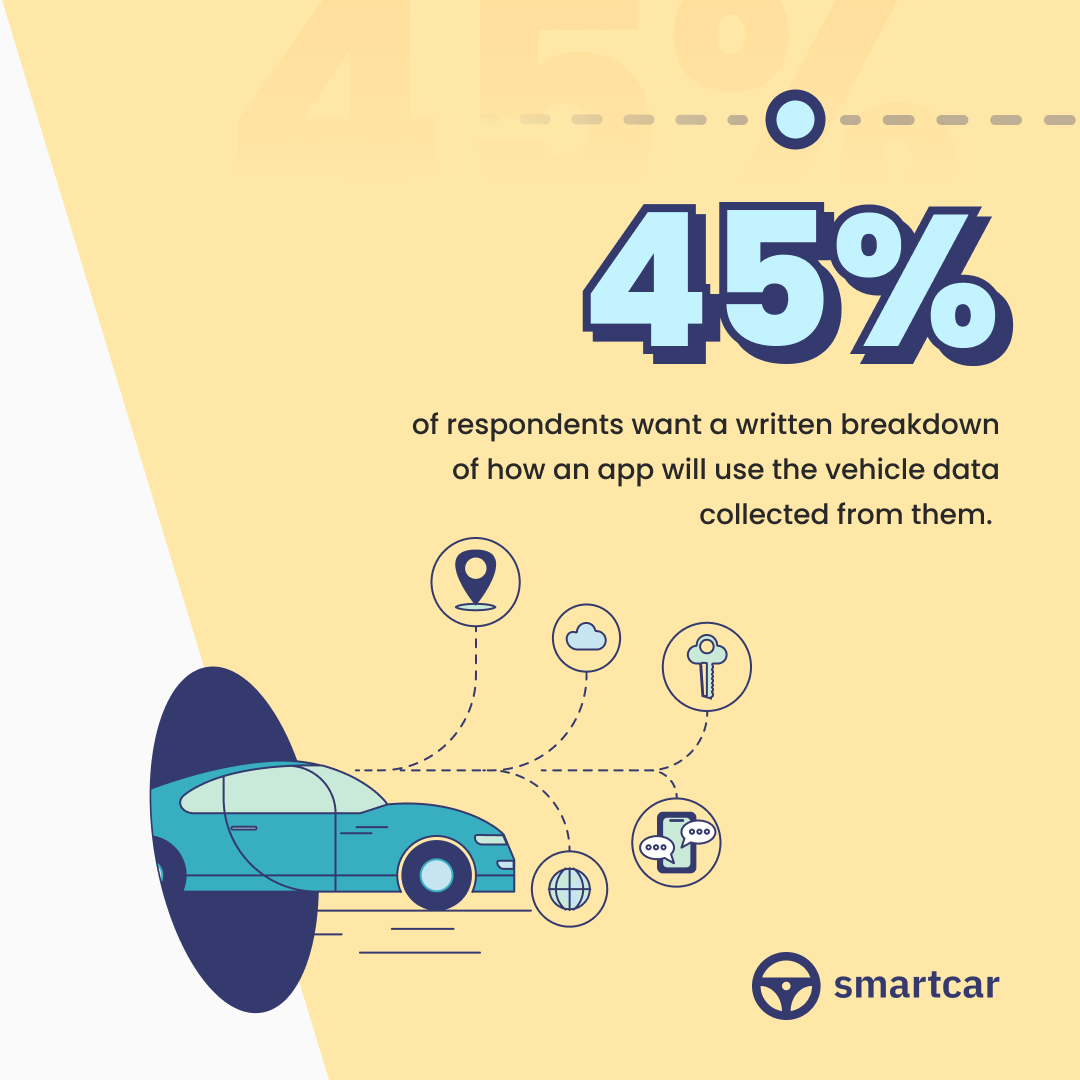

#5: Drivers want data autonomy, transparency, and privacy

If vehicle information is required to power apps and services, drivers want to know how their data is used. They also want complete control over the process of handing that data to external parties — even if that data is anonymized.

However, the terms and conditions presented to drivers for enabling data-sharing aren’t always designed to be understood effectively. This proves to be a big point of friction and a cause of distrust among drivers who want complete certainty on who and what has access to their sensitive data.

“When you’re able to communicate [these terms and conditions] in a very visual, very simple way where a customer gets to opt in and say, ‘Yes, I agree to share certain information about my vehicle with Recurrent so they can make my EV ownership better,’ — and that's one thing versus having 30 pages worth of legalese that's only really meant for lawyers to deal with,” Dan says.

This doesn’t mean drivers don’t want to share their data. It means that drivers are willing to share that data under the right conditions with the applications of their choice. Research by TechInsights in China, North America, and Europe found that consumers are willing to exchange their privacy for a value proposition.

"The only problem we have in the [automotive] industry is that that exchange is not really explicit and is not really being spelled out.

Automakers will recite the catechism that the customer owns the data, but the average car owner has no idea where to find the data or has little knowledge of exactly which data is being gathered — and then they hear headlines about car companies selling data now that they may be selling anonymized data."

— Roger Lanctot, Director of Automotive Connected Mobility at TechInsights

Consumers are ready for the future of connected car apps

There isn’t a Swiss army knife to solve all the gaps between transportation infrastructure, electrification targets, and the consumer experience. Vehicle telematics is powerful when different players in the mobility ecosystem are empowered to use their strengths to accelerate innovation in different areas.

Connected services and connected car applications are becoming more ingrained into the vehicle ownership experience, and it’s important that automakers and third-party developers work together to give consumers user-friendly solutions that help them do more with cars — whether it’s by saving money, lowering carbon footprints, improving travel accessibility, or preserving vehicle health and safety.

For more data and insights, download the full report and watch a replay of our panel discussion.